In any organisation, regardless of big or small, the concept of a separate entity and accountability must be in place, or appear to be in place, when outsiders ( investors, or regulators) look into your operations.

In any organisation, regardless of big or small, the concept of a separate entity and accountability must be in place, or appear to be in place, when outsiders ( investors, or regulators) look into your operations.

People from outside do not know the details of your operation and they will make a general remarks that will set tongue wagging, to the detriment of your organisation. Auditors based on the paper trail and the few days of audit work (may seemed unfair to you), to comment on your 365 days of your operations, which the type of challenges you faced, are not measured in dollars and cents.

People can question your marketing and entertainment expenses (or the golden tap that you have) are excessive, but they do not tell you relative to what yardstick. Auditors are not marketing people and they don’t understand until you can or justify (KPI) the expenditure.

You must have at least 2 scenarios, worst case and best case. If I plan to spend 10 dollars on marketing, I will expect a 100 dollar return and a 20 dollar return for a best and worst case, or a 100% or a zero % return as an example, and must be put in dollar and cents (% is just a general guide)

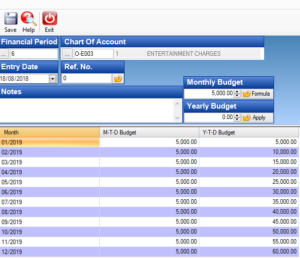

On top of the standard operating procedures , in my personal opinion, I would prepare a budget to all the organisation’s 12-month revenue and expense items, up to the courier charges and the monthly hotel expenses ( do not lump into one single account call travelling expenses) as a separate line item.

Be careful of seasonal change in the revenue & expense items ( based on last 3 years’ result). Finally, get it approved by the various stakeholders.

Do a three month review of the actual versus budgeted variance report and fine-tune ( if it is underestimated or change of circumstances or some info becomes more available) the coming next 3 quarters’ budget. Get it printed out and signed by all stake holders.

If you budgeted for a 5000 dollars entertainment expenses, so be it, you need to justify the revenue of 10 times the amount as set out in your KPI.

If you budgeted for a 5000 dollars entertainment expenses, so be it, you need to justify the revenue of 10 times the amount as set out in your KPI.

If you are not going to have a yardstick (in this case the budget) to measure (or justify) your spending, others will use theirs.

All MCST must also have budget to let your MA run the operations without the fear of being questioned by the SPs, as all expenses are within the budgeted amount set out during the last AGM.

When the trust is lost, you will ended up losing everything you set out to achieve, regardless of how noble your cause is. I am not questioning her character, but how people perceived the matters. Competence is in great demand and is in great supply, however value, though in great demand, is not in great supply.

What value you bring to your organisation and what is your value to the organisation is something you must constantly ask yourself.

This was shared to me by a senior lecturer, Dr Clive Choo of NTU, and it is so profound.

You may be running the top fortune 500 company or a company limited by shares, you are at best an employee of the company (even you are a major shareholders), the money belongs to the company and does not belong to you. The concept of separate entity must set in and the accountability is all the more so important, to show that all actions are carefully thought through.