RealTimme Cloud

Stay relevant, stay competitive by going for seamless filing

We start with you...we grow with you

What is Seamless Filing?

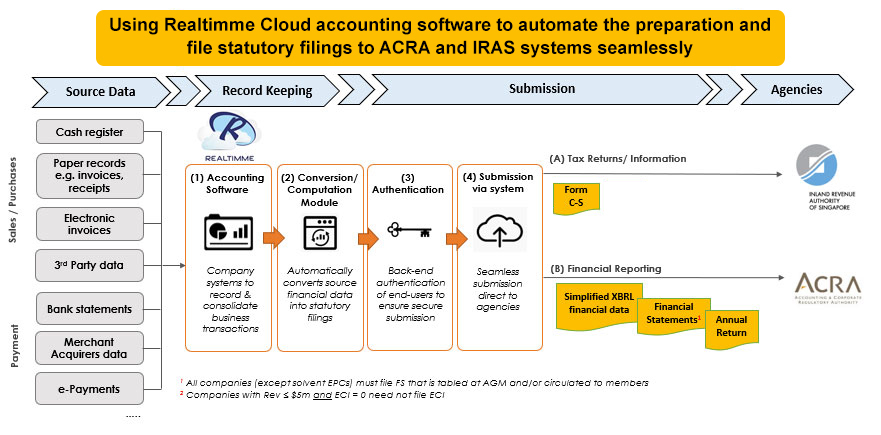

The seamless filing solution incorporates the requirements for filing tax and annual returns into the accounting software, allowing companies to record their operating transactions and generate the required statutory filings using the accounting software. The software is linked to ACRA and IRAS via Application Programming Interfaces (APIs), which enables companies to file their statutory filings without the need to log in to ACRA and IRAS portals.

Benefits

Currently, smaller companies can take up to about 9 hours to manually prepare and file the annual and tax returns with both ACRA and IRAS. With this new seamless filing initiative, it now takes about half-an-hour for these companies to prepare and file Annual Return with Financial Statements in Simplified XBRL format with ACRA, and Corporate Income Tax Return (Form C-S) with IRAS at one go. This translates into time saving of more than 90% for these companies, enabling them to improve efficiency and productivity. Any errors in the annual return and tax filings would also be minimised as the filings are auto-generated using the accounting data within the software, and submitted directly to both agencies.

With seamless filing

- First year only: Prepare your chart of accounts to be tax ready (split deductible and non deductible expenses or taxable and non taxable revenue)

- Finalise your accounts by your accountant

- Prepare and compilation of (un)audited accounts at year end by your corporate service provider

- You or your appointed corporate secretary will login via CorpPass to submit the annual returns to ACRA via Realtimme seamless

- If your company is required to file financial statement, View your simplified XBRL on screen, submit if in good order (and every subsequent year) .

- Pass to your tax agent to submit your corporate tax using CorpPass via Realtimme seamless

- Your tax agent will get a draft and seek your approval from you before filing seamlessly via Realtimme Cloud

- Built in reminders of filing date. Reduced chances of errors or omissions

- Cost savings in 2nd and subsequent years

- Your tax computation need not be prepared outside the system but within Realtimme Cloud Accounting software

Note :

- Online setup and training video and email support will be provided as part of the package for first year submission

- Optional one-to-one setup and training available, please ask for quote

- Built in diagnostic tools and exception reports to show records are not in good order

Who will benefit? With a win-win collaboration

1. Business owners – talk to your tax agent or corporate secretary how your system can prepare for seamless filing and have at least 50% of cost savings by using Realtimme Cloud.

2. Tax agent and corporate secretary – Change your role from doing to checking your clients’ work online. You can take in more jobs with more time savings. check out our partners’ plan

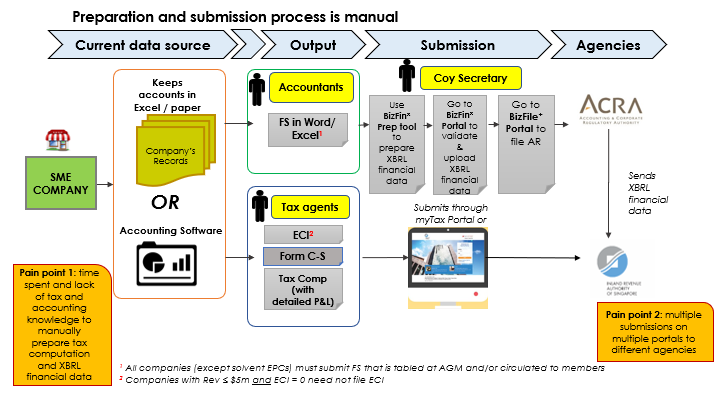

Currently, without seamless filing

- Finalise your accounts by your accountant

- Prepare an audited accounts or a compilation at year end

- Pass to your tax consultant to prepare tax from point 2.

- Your corporate secretary will have a copy of the accounts to submit to ACRA for annual filing from 2.

- Risk of late filing

Frequently Asked Questions

We have make it easy for you to manage yourself so that you can enjoy the cost savings. The system comes with pre-mapped accounts and you can still refer to our online user guide or contact our support. Our built-in smart system will suggest to you what are the possible causes. We have tax consultant to assists you for simple queries.

If you are not sure , you can always submit a question to our tax_support for advice. We have tax consultants ready to answer some of your simple questions. But if the matter is complex, we may suggest to subscribe to our tax service. Please ask for a quote

You can always refer to our online helpfile that will explain , with examples, the terms used. Otherwise we have links to the IRAS or ACRA website for further explanation

Yes, we can offer you this service, please ask for a quote from our sales@realtimme.net

RealTimme Seamless Filing system will make this job simple for your staff. We have a support team to train you for the first year and you can subsequently perform this task on second year onwards.

RealTimme accounts will help your accounts staff identify expenses that are allowable for tax deduction and expense that are disallowed for tax deduction, before they do their accounting entries. This will cut the workload at year end for tax analysis from internal staff. RealTimme accounts will certainly help your company gain efficiency in the tax compliance process.

Not to worry, our support team will train and guide you on the change process via videos, step by step screen shot guides, email in support for help.

Source: ACRA

Watch Explainer Videos 1/4 …click here

ACRA filings

A company can file Annual Return and Financial Statements (in Simplified XBRL format) with ACRA using the accounting software if it meets the following conditions:

- The company has revenue of S$500,0001 or less for the current financial year;

- The company has total assets of S$500,0001 or less as at the current financial year-end; and

- The company is not

- listed or is in the process of issuing its debt or equity instruments for trading on a securities exchange in Singapore;

- listed on a securities exchange outside Singapore; and

- a financial institution.

1The amount threshold of S$500,000 is determined based on the current financial year in the financial statements or (where the company is a parent company) consolidated financial statements as required to be prepared under the Companies Act, regardless of the number of months in that current financial year.

A company can file Annual Return with ACRA using the accounting software if it meets the following condition:

The company is either:

- filing financial statements in PDF format as company limited by guarantee; or

- not required to file financial statements with ACRA as a solvent exempt private company or a dormant relevant company.

Sourc: ACRA , who needs to file financial statement?

IRAS filings

A company can file tax returns to IRAS using the accounting software if it meets the following conditions:

(a) The company must qualify to file Form C-S, i.e.

- incorporated in Singapore;

- has an annual revenue of $5 million or below in the preceding financial year;

- derives income taxable at prevailing corporate tax rate of 17%;

- Not claiming or utilising carry-back of current year capital allowance or losses, group relief, investment allowance or foreign tax credit and tax deducted at source; (

(b) The company maintains Singapore dollar as its functional and presentation currency;

(c) The company is not an investment holding company or a service company that provides only related party services; and

(d) The company does not own subsidiaries, associates or joint ventures, and has no investment in intangibles.

Source : IRAS